On October 4, 2023, Governor Gavin Newsom signed Senate Bill 616, which amends the Healthy Workplaces, Healthy Families Act by expanding the mandatory requirements for Paid Sick Leave in California. Previously, employers were required to provide at minimum 3 days of Paid Sick Leave to CA employees. This update increases the minimum amount of Paid Sick Leave employers must provide to CA employees to 5 days effective January 1, 2024.

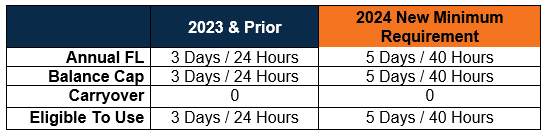

Front Load Method

Employers can opt for a “front load” method by giving employees 5 days (or 40 hours) of Paid Sick Leave at the start of each year. With this method, there is no requirement that unused hours need to roll over the following year as employees are being supplied with the full amount of Paid Sick Leave at the beginning of the year. In the case of a new hire, employers are still permitted to enforce a “waiting period” (no more than 90 days) before a new employee can use their Paid Sick Leave.

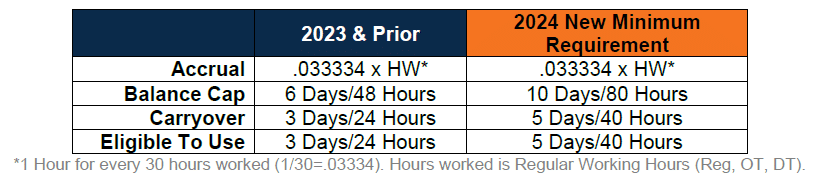

Accrual Method

As an alternative to a front load method, employers can opt for an accrual based method. With an accrual method, employers are required to give employees 1 hour of Paid Sick Leave for every 30 hours worked or have an “alternative” accrual plan that meets certain minimum standards. With an “alternative” accrual plan, employees must accrual at least 3 days (24 hours) of Paid Sick Leave or PTO by the 120th calendar day of the year AND at least 5 days (40 hours) of Paid Sick Leave or PTO by the 200th calendar day.

Previously, employers could cap an employees Paid Sick Leave at 6 days (48 hours) a year, however with this new update effective January 1, 2024, employers must now increase the cap up to the greater of 80 hours or 10 days a year.

Previously, employers could limit Paid Sick Leave to 3 days (24 hours) in a year. With these updates effective January 1, 2024, employees are permitted to use at least 5 days (40 hours) of Paid Sick Leave in a year.

Resources:

Workers Just Got More Paid Sick Days | California Governor

Bill Text – SB-616 Sick days: paid sick days accrual and use. (ca.gov)

Disclaimer: These materials are provided for informational purposes only and are not intended as legal or tax advice. Readers of the IBS Blog should contact their legal or tax professionals to discuss how these matters relate to their individual circumstances.