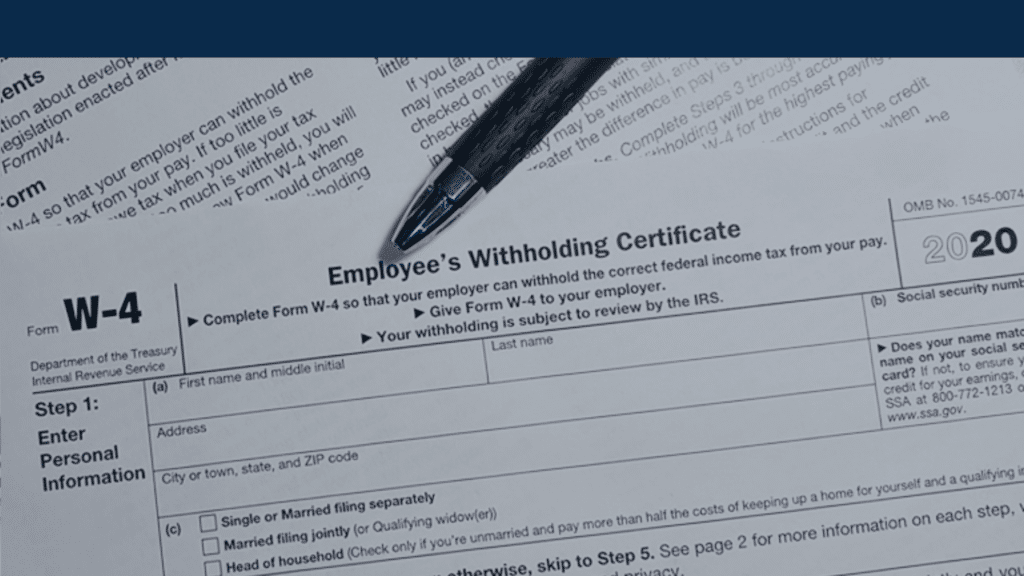

Whether you are a new employee or just needing to update your withholdings, your employer will request you to fill out the Federal W-4 Form. Up until 2020, most people understood that they would just need choose their filing status (S/M/H) and the # of allowances. However – as of 2020, the IRS redesigned the form and did away with the ability to claim personal allowances. Here is what you need to know to understand and complete the Federal W-4 Form.

Note: Any adjustments or changes to withholdings after Jan 1st 2020 must be made using a 2020 form or newer.

Every W-4 form an employer receives should show a completed Step 1 and Step 5.

Steps 2, 3 and/or 4 are completed only if applicable.

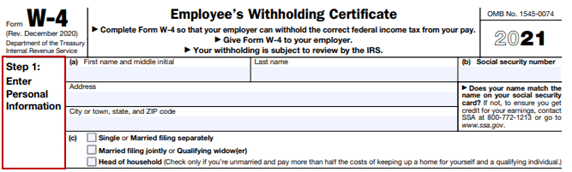

Step 1: Enter Personal Information (*Required)

- 1(a)-1(b): Enter basic information (full name, social security number, & full address)

- 1(c): Choose the anticipated federal filing status.

- Single or Married filing Separately – means you are filing individual tax returns (regardless of if you are married or not).

- Married filing jointly or Qualifying widow(er) – if you are married and filing jointly with your spouse, or if you are a qualifying widow(er). To qualify as a Widow(er) (limited to 2 years) you must meet certain thresholds, for example, you did not remarry during the 2 eligible years, you have a dependent you claim, the dependent lived with you all year, etc.

- Head of Household – available to taxpayers who meet certain thresholds. To qualify for head of household, you must file a separate individual tax return, be considered unmarried, and be entitled to an exemption for a qualifying person (must generally be either a child or a parent of the head of household). The head of household must pay for more than half of the qualifying persons support and housing costs.

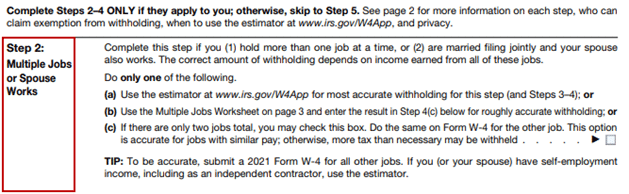

Step 2: Multiple Jobs or Spouse Works (Optional)

- If there is only one job (combined), leave this step blank.

- 2(a)-2(b): two different ways to figure the additional tax you will need to have withheld.

- 2(c): If you have a total of two jobs or are Married Filing Jointly and your spouse has a job, you will need to check the box. If the box is checked, the standard deduction & tax brackets will be cut in half.

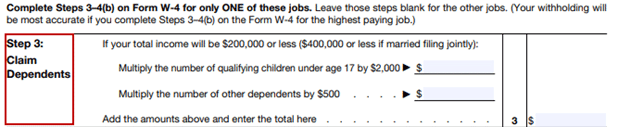

Step 3: Claim Dependents (Optional)

- If no dependents, leave this step blank.

- If you have qualifying dependents, calculate the two categories to get the combined Dependent Tax Credit. Be sure to place the total credit in the far-right hand side box.

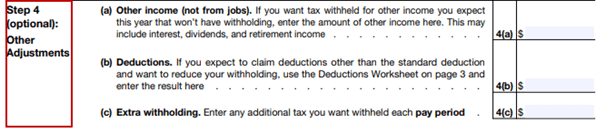

Step 4: Other Adjustments (Optional)

- Leave blank if unapplicable.

- 4(a) – if you want to incorporate other untaxed income you are expecting to receive and want to have taxes withheld each payroll for it you can incorporate the full amount of expected additional income here. This gives you the benefit of paying taxes over time, instead of one lump some when you do your return.

- 4(b) – If you expect to claim any other deductions aside from the standard deduction, you will want to state that amount here. You will want to use the Deductions worksheet to help calculate the amount. This will reduce your taxable income. This includes things like itemized deductions, student loan interest, IRAs, etc.

- 4(c) – If you would like to have an additional dollar amount withheld each pay period, specify that amount here. This amount will be taken in addition to what is calculated every pay period. This will either increase your refund when you do your taxes or reduce the amount that you may potentially owe.

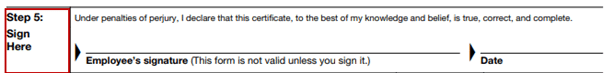

Step 5: Sign (*Required)

- To validate the Federal W-4 form, please sign and date the form.

- This form should then be handed to your employer to update the Payroll.

Employees who have Employee Self-Service can run the UKG paycheck simulator before filling out the form to get real-time withholding calculations. Administrators can also provide a manual check calculation so the employee can see the impact of their filing status before their next live check, to help them know what is coming, and to make sure their federal and state withholding taxes will be adequate over the remaining course of the year.

For additional resources, please visit the following links:

IRS Training Video, Understanding the 2020 Form W-4

IRS Withholding Estimator Information

IRS Publication 15-T, Federal Income Tax Withholding Methods

If you are an administrator needing assistance, please contact Innovative at 707-586-4300 or IBSsupport@ibspayroll.com

Disclaimer: These materials are provided for informational purposes only and are not intended as legal or tax advice. Readers of the IBS Blog should contact their legal or tax professionals to discuss how these matters relate to their individual circumstances.