It is pay day, finally! Although most people are ready to pull off the stub & cash in, its important to review your entire pay statement to ensure accuracy.

Below we will review each section on a pay statement:

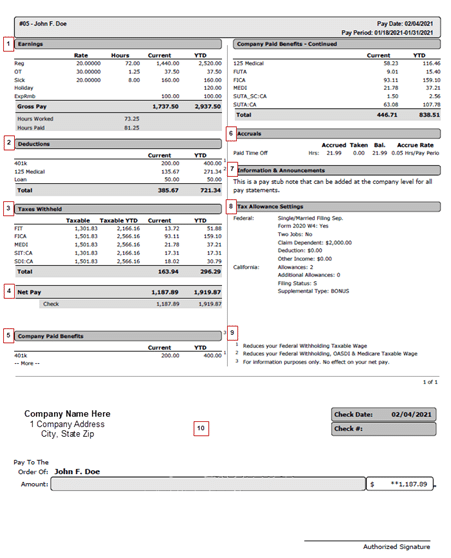

Section 1 : Earnings

This section displays the gross hours & earnings paid to the employee (before taxes and deductions).

Earnings: Displays the YTD Earning Codes Used

Rate: Current pay rate for the specific earning / unit

Hours: Current Hours Being Paid

Current: Displays the current gross pay [Rate x Hours]

YTD: Displays the Year-to-Date Gross Wages Paid

Hours Worked: Total Hours Physically Worked

Hours Paid: Total Hours Paid (includes Time Off)

Section 2 : Deductions

This section displays the Voluntary Deductions withheld from the paycheck (Medical, Retirement, etc)

Deductions: Displays the YTD Deduction Codes Used

Current: Displays the current amount being deducted

YTD: Displays the Year-to-Date Deductions Withheld *Notice legend the right-hand side of the YTD. Reference Section 9

Section 3 : Taxes Withheld

This section displays the Taxes Withheld (example is for an employee working in California). These taxes will vary by State.

Tax Codes: Displays the YTD Tax Codes Used

- Federal Tax Codes

- FIT = Federal Income Tax

- FICA = Federal Social Security

- MEDI = Federal Medical

- California State Tax Codes

- SIT:CA = California Income Tax

- SDI:CA = California State Disability Insurance

Taxable: Displays the current taxable wages (Calculations differ by Earning & Deduction Codes used; Taxable Gross Earnings – Section 125 Deductions / Retirement Deductions = Taxable Wage subject to taxation)

Taxable YTD: Displays the Year-to-date taxable wages.

Current: Displays the current taxes withheld. It uses the Taxable Wages to calculate the amount to withhold. [2021 Rates: FIT based on W-4, FICA = 6.2%, MEDI = 1.45%, SIT:CA based on DE-4, & SDI:CA 1.2%]

YTD: Displays the Year-to-date taxes withheld.

Section 4 : Net Pay

This displays the take home pay that you can post to your account.

Net Pay: The amount of take-home pay (Gross Pay – Vol Deductions – Taxes Withheld = Net Pay).

Check: If it displays as “Check” this means this is a live check that will need to be physically cashed by the bank.

Direct Deposit: Typically displayed as “DD1” “Checking” “Saving” etc. It will also be followed by the last 4 of the account number. If you have multiple direct deposit accounts, they will each be listed with the amount being funded. This means the money will be directly deposited on pay day into the respective bank account(s).

YTD: Although not titled YTD, the far-right column amount is the Year-to-Date net pay.

Section 5 : Company Paid Benefits

This section displays Employer Paid Benefits. These do not affect Gross Pay or Net Pay. This is for informational purposes only. This is to inform of your entire benefit package.

Deductions: Displays the YTD Employer Deduction Codes Used

Current: Displays the current Employer Deductions Paid

YTD: Displays the Year-to-Date Employer Deductions Paid

Section 6 : Accruals

This section displays the Time Off Accrual Balances. These amounts are based on the company defined Policy Year. The Policy year can be based on a calendar year 1/1, a fiscal year 7/1, or Anniversary Date.

Time Off: Will list the applicable time offs.

Accrued: Displays the Total Accrued Time from start of Policy Year

Taken: Displays the Total Time Off Taken from start of Policy Year

Balance: Displays the Total Available (unused) Time Off Taken from start of Policy Year

Accrual Rate: Displays the rate in which you accrue time off. Examples of how Time Off can be accrued are per pay period, per hour worked, front loaded, or manually defined by your employer.

Section 7 : Information & Announcements

This section displays any company announcements or personal messages from your Employer.

Section 8 : Tax Allowance Settings

This section displays your current filing status. The Federal Filing status is determined based on the W-4 submitted to your employer. The State (California, for this example) is based on the state withholding form (CA DE4). It is important to reference your Taxable Wages and amounts for FIT & SIT throughout the year, to make sure you are withholding enough taxes. If you need to adjust your taxes, you will need to submit a new W4 or state withholding form to your Employer.

Section 9 : Legend

This section displays the legend for deductions, letting you know the taxability.

Section 10 : Pay Stub

This section displays your net pay information. If this is a live check, you will need to tear along the perforated edge and cash this check. If this is a direct deposit, you will just see a confirmation of each of the accounts and the amount of money being deposited.

If you are an employee needing help understanding your Pay Statement, or see a mistake, please contact your administrator.

If you are an administrator needing help understanding the Pay Statements, or need help correcting a mistake, please contact Innovative at 707-586-4300 or IBSsupport@ibspayroll.com

Disclaimer: These materials are provided for informational purposes only and are not intended as legal or tax advice. Readers of the IBS Blog should contact their legal or tax professionals to discuss how these matters relate to their individual circumstances.