It is that time of year again – Tax Filing!

By now, you should have received your 2022 W2 Form. Although it may look like gibberish and you feel like your just a middle man to your tax provider, it is important for you to understand what is on your W2.

To help you understand your Form W2, we have outlined each of the W2 Boxes below:

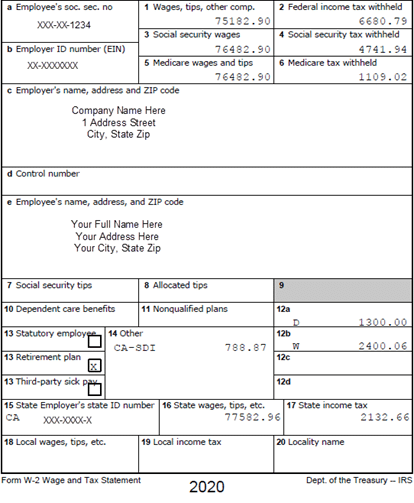

Federal Boxes (1-14)

Box 1 – the total amount of wages subject to Federal Income Tax. [FIT]

Note: The Gross Pay on your pay statement will not always match Box 1 / Box 16 wages due to reductions for section 125 deductions and qualified retirement deferrals.

Box 2 – the total amount of Federal Income Taxes withheld from your paycheck. Determined by your Elections on form W-4.

Box 3 – the total amount of wages subject to Social Security Tax. Max Wage Limit for 2020 is $137,700. [FSOC]

Box 4 – the total amount of Social Security Taxes withheld from your paycheck throughout the year [Box 3 x 6.2%].

Box 5 – the total amount of wages subject to Federal Medicare Tax [FMED]

Box 6 – the total amount of Medicare Taxes withheld from your paycheck throughout the year. [Box 5 x 1.45% up to $200k; 2.35% over $200k]

Box 7 – Tip income reported to employer. If box is blank, no tips were reported (unreported tips are still taxable).

Note: If you forget to enter Box 7 wages, you may receive an erroneous message that Box 4 FICA has been over withheld.

Box 8 – Tip income allocated to you by your employer.

Box 9 – This box may or may not be populated with a 16-digit verification code. This is an added security initiative by the IRS. If the W2 does display a code, enter it when doing your tax return (electronically filed returns only). If the code is not populated, skip this section.

Box 10 – the total amount of dependent care benefits provided under a dependent care assistance program.

Box 11 – the total amounts distributed to you from your employer’s non-qualified (taxable) deferred compensation plan. This does not include amounts contributed by you.

Box 12 – Various Form W-2 Codes will appear in Box 12. For a detailed list of codes & meanings, flip your W2 over or you can visit: https://www.irs.gov/pub/irs-pdf/iw2w3.pdf (Page 30: Table)

Box 13 – box(es) will be checked if you are 1) Statutory employee – earnings are subject to Social Security & Medicare taxes but not Federal Income Taxes; 2) Retirement Plan – if you participated in your employer’s retirement or pension plan during the year; or 3) Third-Party Sick Pay – if you received sick pay under your employers third-party insurance policy.

Box 14 – This is an itemizing / catch all box. Employers will use this box to report information such as State Disability Taxes, Union Dues, FFCRA (Covid) Earnings, Health Insurance Prems, Nontaxable Income, Fringes, etc). There is no standardized list of Box 14 codes (employers can list any description they choose). If you are unclear at what an amount is in box 14, contact your employer.

State & Local Boxes (15-20)

Box 15 – Abbreviation of State in which taxes were withheld followed by the Employer’s State ID #

Box 16 – the total amount of wages subject to State Income Tax. [SIT]

Box 17 – the total amount of State Income Taxes withheld from your paycheck throughout the year. Determined by your Elections (CA uses EDD DE-4 Form: https://www.edd.ca.gov/pdf_pub_ctr/de4.pdf).

Box 18 – the total amount of wages subject to Local Income Tax (if applicable).

Box 19 – the total amount of Local Taxes Withheld for Locality in Box 20

Box 20 – Name (Town/City/Local) for which local taxes are withheld.

****Additional instructions can be found on the reverse side of your W2.

If you are an employee needing help understanding your W2, or see a mistake, please contact your administrator.

If you are an administrator needing help understanding the W2s, or need to report a mistake, please contact Innovative at 707-586-4300 or IBSsupport@ibspayroll.com

Disclaimer: These materials are provided for informational purposes only and are not intended as legal or tax advice. Readers of the IBS Blog should contact their legal or tax professionals to discuss how these matters relate to their individual circumstances.